entertains, educates & inspires marriages

Find Marriage Answers

advice

Taking Stock: 7 Positive Indications That the Stock Market Boom Is Here to StayWith the stock market hitting new highs, many people are asking if it's time to get back in? Yes! Here's seven reasons why.

DepositPhoto

The market has more than stabilized from its recent lows, and it a good time to invest.

“ Understanding the difference between bad debt and good debt is imperative to becoming financially literate and financially independent.”

|

"In the twentieth century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497." ~Warren Buffett

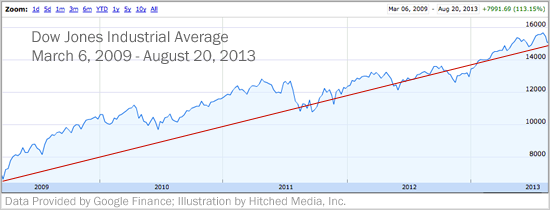

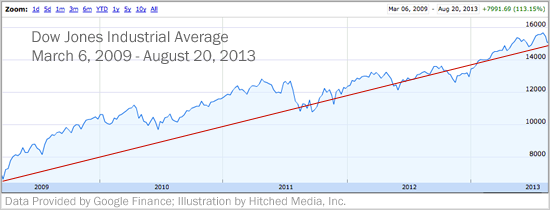

Since the financial crisis hit back in 2007, many Americans have kept a wary eye on the stock market. After years of dismal prospects, they just can’t quite come around to the idea that the stock market is the best place to invest their money. And for good reason. After all, the past 10-13 years have been coined the "Lost Decade" and make up what has been one of the worst 10-year periods for the U.S. economy since the 1930s. However, things aren't looking so bleak anymore. In fact, the Dow Jones Industrial Average has more than doubled from its lowest point during the Great Recession of nearly 6,500 to record-breaking highs that top 15,000. I think the future is bright and I am encouraging Americans to put their faith back in the stock market.

First and foremost, you must remember that when it comes to the stock market, you have to play the long game. Historically it has produced very attractive returns. Since 1927, the S&P 500 has provided an average 10-year annualized rate of return in excess of 10 percent, even after including the past 13 years, according to Thomson InvestmentView. When you look back at the stock market’s history, you’ll see that the market has demonstrated strength in the face of challenges, and long-term investors have generally been pleased with their investments.

Of course, many Americans remain concerned about major economic factors such as the national debt, potential insolvency of Social Security and Medicare, the high unemployment rate, the European Union’s economic climate, gridlock in Washington, and slowing demand in China.

All of this negative news has been out there for years and has created significant fear in the market, not to mention the distrust many investors have in the system as a result of the many financial scandals and cases of self-dealing that have come from Wall Street.

But in my opinion, if you have not already started making the shift from bonds to stocks in your overall investment model, you need to start rethinking your allocation. Don’t make any drastic moves, but simply make gradual shifts from bonds to stocks over the next several years. That’s a great way to ease back in.

Bottom line: The healing process has begun. Here are seven positive indicators demonstrating that the market is experiencing a sustainable recovery:

1. More people are living within their means. Many individual families have made the difficult but necessary decision to start living responsibly and living within their means. By doing so, not only are they contributing to a more stabilized economy, they’ve also taken the single most important step toward becoming financially independent. The Federal Reserve reported that consumer debt stood at $11.5 trillion in the second quarter of 2013, down 0.7% from the previous quarter and below the $12.68 trillion peak reached in 2008.

Living within your means does not mean living on credit or on loans. Living within your means does not mean turning to parents or friends to pay the tab when you cannot quite meet the rent or need to buy a new computer. It means not only figuring out how to pay for your needs and wants, but budgeting your income so that you still have 10 percent or more left over to put toward your savings and long-term financial goals.

2. Refinanced mortgages mean more cash flow and less debt. Almost everyone who has qualified to refinance their mortgage has already done so and is enjoying the added cash flow from a reduced mortgage payment and interest cost. The Fed report also showed outstanding mortgage balances fell by $91 billion in the second quarter.

Understanding the difference between bad debt and good debt is imperative to becoming financially literate and financially independent. Affordable mortgages certainly fall into the good debt category. As we saw with the financial crisis, bad debt can lead to grave financial circumstances. But as more people learn to use debt to leverage themselves in the pursuit of accumulating wealth, they’ll find that it can be a very powerful tool, and as their financial outlook improves, so too will the overall economy’s.

3. Commodity prices are decreasing. Prices of commodities have been coming down, and there is little or no sign of inflation on the horizon. And because commodity prices are down, American families are keeping more of their money each week. Individual families are saving more, paying down debt, and slowly but surely rebuilding their statement of financial position, which is increasing their financial net worth.

4. Corporate America and the banking system are getting back on track. Corporate America has never been leaner, meaner, and stronger financially. Many U.S. corporations have extremely strong balance sheets that include piles of cash waiting to be used for expansion and growth, not to mention the historically low cost of financing.

At the same time, the banking system has dramatically improved its financial position by writing off bad assets, taking advantage of free money, and making more prudent lending and business decisions. I believe that these businesses are on the verge of putting a lot of this money back into the system, which will lead us back into prosperity.

5. The federal government has made necessary financial changes. Our federal government has finally made the unpopular but necessary decision to raise taxes and cut back on spending. Just as individuals need to live responsibly and within their means, so too does our federal government. And though they have certainly had their flaws, since the beginning of this year, I have seen signs that our politicians are finally doing what it will take to rebuild our country’s financial standing.

6. Consumers have more confidence in the market. The major factors that took us out of the Great Depression were an increase in trust in the markets by the creation of the SEC in 1933 and advances in technology that increased productivity and created new jobs and opportunities. I think that the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act has gone a long way in helping restore confidence in the markets just as the creation of the SEC did after the Great Depression.

7. Jobs are coming back home. Advances in technology, the transformation of America’s energy future with natural gas, and the industrial renaissance should give us good reason to believe that we are heading in the right direction when it comes to job creation. There is a U.S. renaissance taking place that will revolutionize America’s energy future. During the past several years, there has been a dramatic increase in the amount of natural gas that can be recovered in North America. This transformation may eventually lead the U.S. to finally achieve energy independence.

This is a really big deal and can be a game changer to the U.S. economy. This U.S. renaissance is already spilling over to the manufacturing industry and is bringing jobs back home. We are actually starting to build things once again thanks to the major advantage we now have as a result of an overabundance of natural gas at a fraction of the cost. This technology has prompted a variety of companies to start building and expanding, and many others have already started making the move back to the U.S.

By identifying these major shifts and events affecting our economy, smart investors set themselves up to profit handsomely over the long run. I believe it is time to become more optimistic about our country’s future, and a great way to do that is to make a gradual shift out of bonds and into stocks over the coming years.

Disclosure: The S&P 500 is an index of 500 major, large-cap U.S. corporations. You cannot invest directly in an index.

Disclosure: Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Dollar-cost averaging does not assure a profit and does not protect against loss in declining markets. Such a plan involves continuous investment in securities regardless of the fluctuation of price levels of such securities. An investor should consider his or her financial ability to continue his or her purchases through periods of low price levels.

John J. Vento is author of Financial Independence (Getting to Point X): An Advisor’s Guide to Comprehensive Wealth Management, www.ventocpa.com). He has been the president of the New York City-based Certified Public Accounting firm John J. Vento, CPA, P.C., and Comprehensive Wealth Management, Ltd., since 1987. Mr. Vento is a Certified Public Accountant, a Certified Financial Planner, and has an MBA in Taxation. His organization is focused on professional practices, high net worth individuals, and those committed to becoming financially independent. He has been the keynote speaker at various seminars and conferences throughout the U.S. that focus on tax and financial strategies that create wealth. John has been ranked among the most successful advisors of a nationwide investment service firm and has held this distinction since 2008.

Since the financial crisis hit back in 2007, many Americans have kept a wary eye on the stock market. After years of dismal prospects, they just can’t quite come around to the idea that the stock market is the best place to invest their money. And for good reason. After all, the past 10-13 years have been coined the "Lost Decade" and make up what has been one of the worst 10-year periods for the U.S. economy since the 1930s. However, things aren't looking so bleak anymore. In fact, the Dow Jones Industrial Average has more than doubled from its lowest point during the Great Recession of nearly 6,500 to record-breaking highs that top 15,000. I think the future is bright and I am encouraging Americans to put their faith back in the stock market.

First and foremost, you must remember that when it comes to the stock market, you have to play the long game. Historically it has produced very attractive returns. Since 1927, the S&P 500 has provided an average 10-year annualized rate of return in excess of 10 percent, even after including the past 13 years, according to Thomson InvestmentView. When you look back at the stock market’s history, you’ll see that the market has demonstrated strength in the face of challenges, and long-term investors have generally been pleased with their investments.

Of course, many Americans remain concerned about major economic factors such as the national debt, potential insolvency of Social Security and Medicare, the high unemployment rate, the European Union’s economic climate, gridlock in Washington, and slowing demand in China.

All of this negative news has been out there for years and has created significant fear in the market, not to mention the distrust many investors have in the system as a result of the many financial scandals and cases of self-dealing that have come from Wall Street.

But in my opinion, if you have not already started making the shift from bonds to stocks in your overall investment model, you need to start rethinking your allocation. Don’t make any drastic moves, but simply make gradual shifts from bonds to stocks over the next several years. That’s a great way to ease back in.

Bottom line: The healing process has begun. Here are seven positive indicators demonstrating that the market is experiencing a sustainable recovery:

1. More people are living within their means. Many individual families have made the difficult but necessary decision to start living responsibly and living within their means. By doing so, not only are they contributing to a more stabilized economy, they’ve also taken the single most important step toward becoming financially independent. The Federal Reserve reported that consumer debt stood at $11.5 trillion in the second quarter of 2013, down 0.7% from the previous quarter and below the $12.68 trillion peak reached in 2008.

Living within your means does not mean living on credit or on loans. Living within your means does not mean turning to parents or friends to pay the tab when you cannot quite meet the rent or need to buy a new computer. It means not only figuring out how to pay for your needs and wants, but budgeting your income so that you still have 10 percent or more left over to put toward your savings and long-term financial goals.

2. Refinanced mortgages mean more cash flow and less debt. Almost everyone who has qualified to refinance their mortgage has already done so and is enjoying the added cash flow from a reduced mortgage payment and interest cost. The Fed report also showed outstanding mortgage balances fell by $91 billion in the second quarter.

Understanding the difference between bad debt and good debt is imperative to becoming financially literate and financially independent. Affordable mortgages certainly fall into the good debt category. As we saw with the financial crisis, bad debt can lead to grave financial circumstances. But as more people learn to use debt to leverage themselves in the pursuit of accumulating wealth, they’ll find that it can be a very powerful tool, and as their financial outlook improves, so too will the overall economy’s.

3. Commodity prices are decreasing. Prices of commodities have been coming down, and there is little or no sign of inflation on the horizon. And because commodity prices are down, American families are keeping more of their money each week. Individual families are saving more, paying down debt, and slowly but surely rebuilding their statement of financial position, which is increasing their financial net worth.

4. Corporate America and the banking system are getting back on track. Corporate America has never been leaner, meaner, and stronger financially. Many U.S. corporations have extremely strong balance sheets that include piles of cash waiting to be used for expansion and growth, not to mention the historically low cost of financing.

At the same time, the banking system has dramatically improved its financial position by writing off bad assets, taking advantage of free money, and making more prudent lending and business decisions. I believe that these businesses are on the verge of putting a lot of this money back into the system, which will lead us back into prosperity.

5. The federal government has made necessary financial changes. Our federal government has finally made the unpopular but necessary decision to raise taxes and cut back on spending. Just as individuals need to live responsibly and within their means, so too does our federal government. And though they have certainly had their flaws, since the beginning of this year, I have seen signs that our politicians are finally doing what it will take to rebuild our country’s financial standing.

6. Consumers have more confidence in the market. The major factors that took us out of the Great Depression were an increase in trust in the markets by the creation of the SEC in 1933 and advances in technology that increased productivity and created new jobs and opportunities. I think that the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act has gone a long way in helping restore confidence in the markets just as the creation of the SEC did after the Great Depression.

7. Jobs are coming back home. Advances in technology, the transformation of America’s energy future with natural gas, and the industrial renaissance should give us good reason to believe that we are heading in the right direction when it comes to job creation. There is a U.S. renaissance taking place that will revolutionize America’s energy future. During the past several years, there has been a dramatic increase in the amount of natural gas that can be recovered in North America. This transformation may eventually lead the U.S. to finally achieve energy independence.

This is a really big deal and can be a game changer to the U.S. economy. This U.S. renaissance is already spilling over to the manufacturing industry and is bringing jobs back home. We are actually starting to build things once again thanks to the major advantage we now have as a result of an overabundance of natural gas at a fraction of the cost. This technology has prompted a variety of companies to start building and expanding, and many others have already started making the move back to the U.S.

By identifying these major shifts and events affecting our economy, smart investors set themselves up to profit handsomely over the long run. I believe it is time to become more optimistic about our country’s future, and a great way to do that is to make a gradual shift out of bonds and into stocks over the coming years.

Disclosure: The S&P 500 is an index of 500 major, large-cap U.S. corporations. You cannot invest directly in an index.

Disclosure: Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Dollar-cost averaging does not assure a profit and does not protect against loss in declining markets. Such a plan involves continuous investment in securities regardless of the fluctuation of price levels of such securities. An investor should consider his or her financial ability to continue his or her purchases through periods of low price levels.

John J. Vento is author of Financial Independence (Getting to Point X): An Advisor’s Guide to Comprehensive Wealth Management, www.ventocpa.com). He has been the president of the New York City-based Certified Public Accounting firm John J. Vento, CPA, P.C., and Comprehensive Wealth Management, Ltd., since 1987. Mr. Vento is a Certified Public Accountant, a Certified Financial Planner, and has an MBA in Taxation. His organization is focused on professional practices, high net worth individuals, and those committed to becoming financially independent. He has been the keynote speaker at various seminars and conferences throughout the U.S. that focus on tax and financial strategies that create wealth. John has been ranked among the most successful advisors of a nationwide investment service firm and has held this distinction since 2008.

Leave a Comment

|

|

|

|

threshold | life | money | sex | blog | married life social network | partners | directory | wine club | podcasts | newsletters | subscribe | advertise | contact us | press releases | archives | privacy policy

Copyright © 2023 Hitched Media, Inc. All rights reserved. | hitched - entertains, educates & inspires marriages |